Revenue Leakage is Real—Here’s How to Stop It with Salesforce

Most organizations aren't losing revenue because of lack of demand. They're losing it because of broken internal systems.

Revenue leakage refers to revenue that has been earned but never collected. On average, companies lose between 1% and 5% of their earnings to revenue leakage each year.

It happens quietly through incorrect pricing, manual billing errors, unclaimed renewals, or unapproved discounts.

Why Most Businesses Miss It

Leakage rarely shows up in standard reporting dashboards. It’s spread thinly across departments: Sales quoting inconsistencies, Finance billing delays, Legal contract hold-ups, and Ops working in outdated systems. The issue isn't siloed. It's systemic.

When quoting, contracting, billing, and revenue recognition live in disconnected tools, tracking where revenue drops become nearly impossible.

The result? Forecasts fall short, renewals get missed, and finance teams are left reconciling errors at quarter-end.

Where Revenue Leaks Happen Most

Based on hundreds of RevOps assessments, these are the five most common leakage points:

1. Manual Quoting Errors

Sales reps use outdated price books, create off-brand bundles, or apply incorrect terms.

2. Unapproved Discounts

Discounting decisions made in silos aren't tracked or governed by deal size or margin thresholds.

3. Contracting Bottlenecks

Legal reviews stall deals, renewals are missed, and there’s no alert system to flag expiring agreements.

4. Billing Inaccuracies

Usage-based, milestone, or recurring billing handled manually often leads to underbilling or disputes.

5. Lack of Renewal Intelligence

There’s no centralized system flagging cross-sell or upsell moments, leading to lost expansion revenue.

How Salesforce Revenue Cloud Fixes It

Salesforce Revenue Cloud connects quoting, billing, subscription management, and revenue recognition into a unified Quote-to-Cash system. That means fewer handoffs, less manual work, and real-time visibility into every dollar earned.

Key Capabilities:

Configure, Price, Quote (CPQ)

- Automates product configuration, pricing logic, and discount approvals

- Standardizes quoting across global teams

- Enforces compliance before contracts are signed

Contract Lifecycle Management (CLM)

- Manages legal terms, clause libraries, and version control

- Tracks amendments and renewal cycles with automation

- Reduces deal delays and improves legal governance

Salesforce Billing

- Supports recurring, milestone, and usage-based billing models

- Aligns invoices with quote and contract terms

- Eliminates rework between Sales and Finance

Subscription Management

- Automates renewals, upgrades, and downgrades

- Flags expansion opportunities proactively

- Tracks lifecycle metrics like ARR, MRR, and churn

Revenue Recognition

- Complies with ASC 606 and IFRS 15

- Maps recognition to delivery and performance obligations

- Delivers audit-ready financial data on demand

When all modules work together, revenue flows without friction and loss.

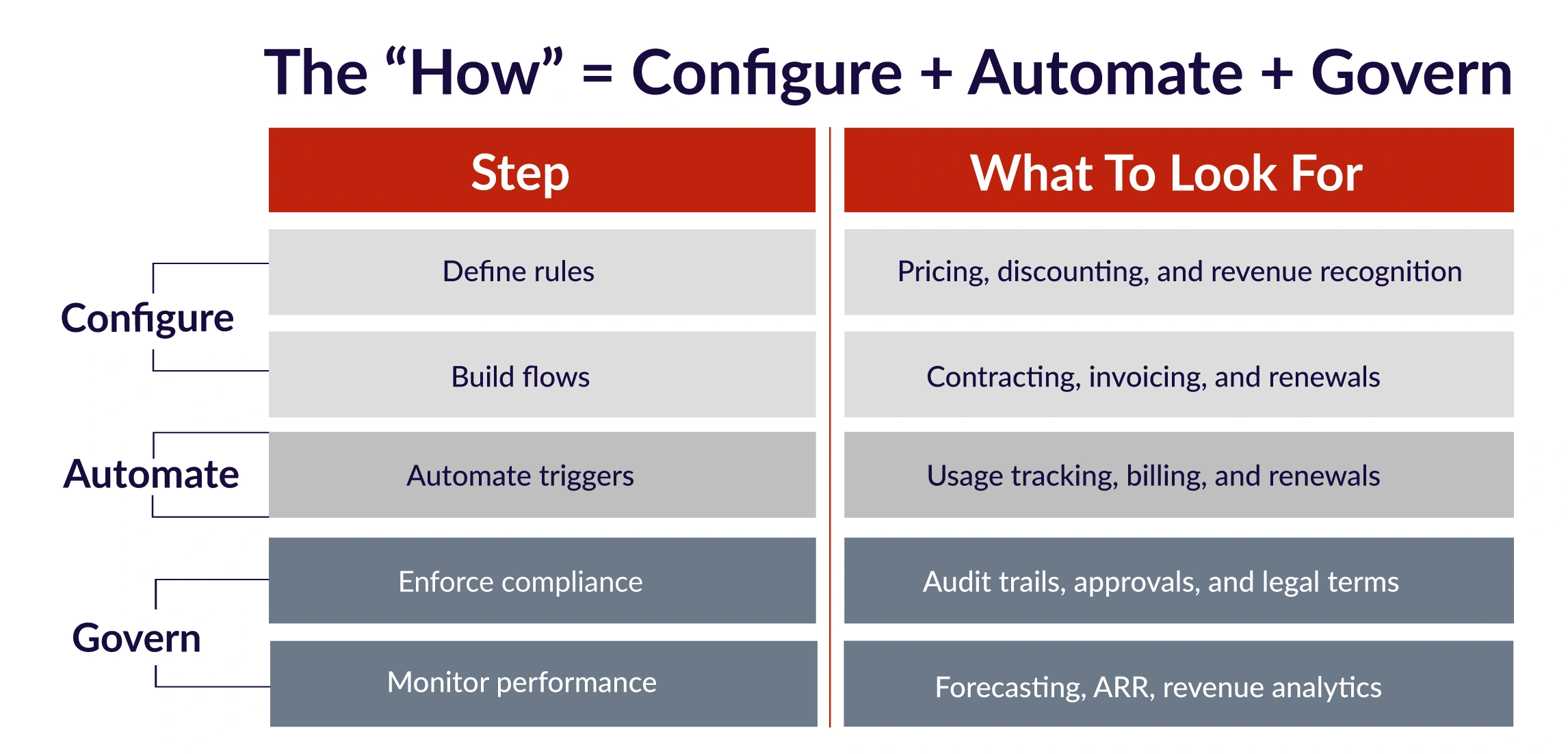

How to Use Salesforce Revenue Cloud to Fix Revenue Leakage

1. Standardize Your Pricing and Discount Rules (via CPQ)

- Define all product configuration logic, dependencies, and pricing tiers.

- Create guardrails for discount approvals (e.g., anything >15% needs VP approval).

- Use CPQ’s Advanced Approvals to automate routing based on deal value, region, or product line.

- Train reps on guided selling flows to reduce dependency on tribal knowledge.

2. Automate Contract Creation and Renewal Triggers (via CLM)

- Use CLM to build a clause library and standard templates for NDAs, MSAs, and Order Forms.

- Set up automated version control and eSignature workflows.

- Create renewal reminders 90/60/30 days out for Sales and Customer Success.

3. Align Billing Models with Actual Customer Usage (via Salesforce Billing)

- Choose billing triggers: Order-based, milestone-based, usage-based.

- Map each product SKU to the correct billing type.

- Use Usage Summaries to pull actual usage data (e.g., licenses used, GB consumed).

- Automate invoice generation and sync with ERP or accounting tools like NetSuite.

4. Manage the Entire Subscription Lifecycle (via Subscription Management)

- Create rules for how subscriptions are renewed, paused, cancelled, or modified mid-cycle.

- Use the platform to prorate charges automatically when customers upgrade mid-term.

- Track ARR/MRR metrics in real time across customer segments.

5. Automate Revenue Recognition (via Rev Rec Engine)

- Define revenue recognition rules for each product (e.g., upfront, over 12 months, based on delivery milestones).

- Set up performance obligation triggers.

- Sync with Salesforce Billing and CPQ so revenue aligns with invoicing and fulfillment.

FAQs

Revenue leakage refers to money a business has earned but fails to collect, due to process inefficiencies, manual errors, or system gaps. It often happens during quoting, contracting, billing, or renewal stages.

The most common causes include:

- Manual quoting or pricing errors

- Discounts offered without approvals

- Missed contract renewals

- Inaccurate or delayed billing

- Disconnected tools across Sales, Finance, and Legal

Look for signs like:

- Frequent invoice disputes

- Uncollected receivables

- Delayed or unpredictable cash flow

- High churn with no upsell tracking

Revenue leakage is often revealed during revenue audits, system integration reviews, or forecasting inconsistencies.

Yes. Salesforce Revenue Cloud connects quoting, billing, contracts, subscriptions, and revenue recognition into one system. It enforces pricing logic, automates billing, triggers renewals, and aligns revenue recognition—closing common leak points.

Conclusion

Most companies have worked hard to generate revenue. But too few have built systems to preserve it. Salesforce Revenue Cloud gives organizations the infrastructure to stop leakage, accelerate cash flow, and create predictable revenue—from quote to recognition.

As the leading Salesforce AI consultancy, Bolt Today helps businesses eliminate revenue blind spots by unifying their Q2C lifecycle, simplifying billing complexity, and enabling long-term scalability.

Looking to identify hidden revenue drains and optimize your operations?

Partner with Bolt Today to make your revenue process as powerful as your pipeline.